Port-Related Local Government Revenue & Property Taxes

Port-Related Local Government Revenue & Property Taxes

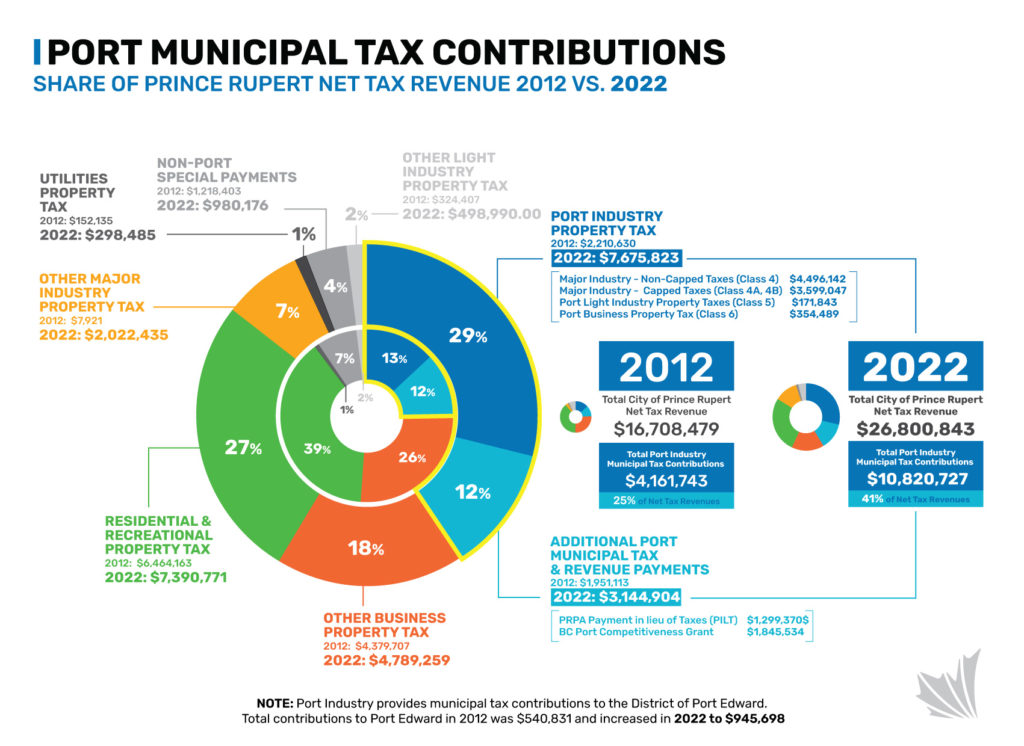

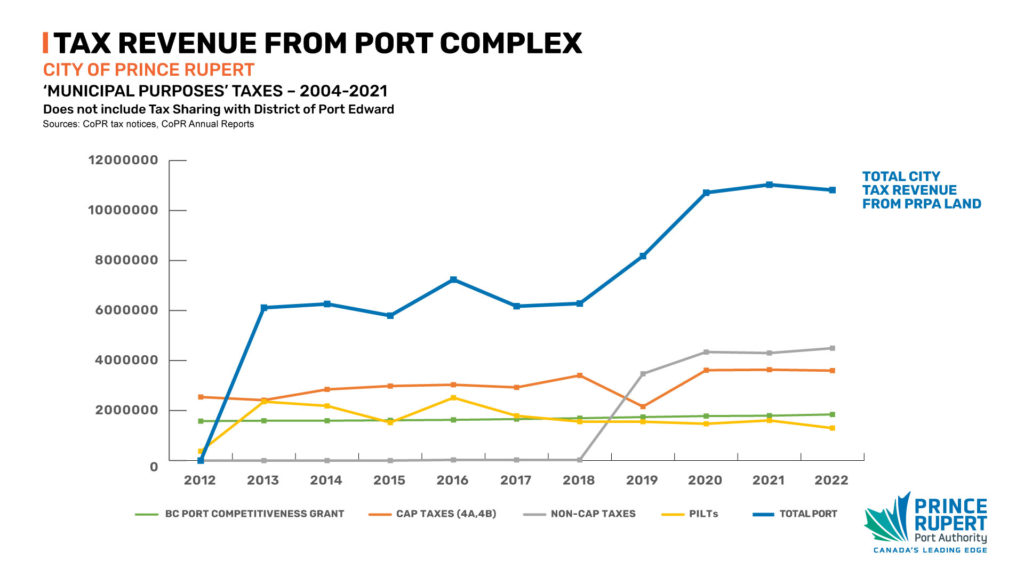

Revenues to local municipal governments from the Prince Rupert Port Authority’s (PRPA) port properties totalled over $12 million in 2021 and represent a significant portion of the City of Prince Rupert and District of Port Edward’s tax revenues. These revenues have grown from $4.9 million per year in 2011 to $12.4 million in 2021—a 153% increase in the last 10 years.

The City of Prince Rupert receives the vast majority of these revenues and they made up 43% of the City’s net tax revenue in 2021. More information on City tax revenue sources can be found in its annual report and financial statements here.

What are the ways that a municipal government collects revenue from port properties?

Four primary tax sources provide municipalities tax revenue from properties within PRPA jurisdiction:

- Property taxes from PRPA tenants: After PRPA has leased property to a third-party, it is subject to regular valuation by BC Assessment, taxes are paid by those tenants based on the municipal mill rate – a multiplier of the assessed value of the property by the tax rate that is expressed as dollars of tax per $1,000 of assessed value. Examples of such properties in Prince Rupert include the Ridley Island Propane Export Terminal, logistics and warehousing operations, administrative and inspection services, retail and office operations, and other port-related service activities.

- Property taxes from PRPA tenants that are eligible under the BC Port Property Tax Act and its associated property tax caps: After PRPA has leased property to a third-party, it is subject to regular valuation by BC Assessment. If it is a marine terminal as defined in the BC Ports Property Tax Act, taxes are paid by those tenants based on maximum limits set by the Act for municipal mill rates. The eligible Prince Rupert terminals are Fairview Container Terminal, Prince Rupert Grain Terminal, Trigon Terminals, and Westview Wood Pellet Terminal. Read more about the BC Port Property Tax Act below.

- BC’s Port Competitiveness Tax Grant: In order to compensate for the establishment of the port property tax caps noted above, the BC Government provides a grant annually to affected municipal governments. This grant increases every year to reflect inflation, but not changes in tax assessment. In the case of Prince Rupert, this grant does not cover the full gap between tax cap rates and current City mill rates for major industry. In 2021, the gap was roughly $1.6 million.

- Payments In Lieu of Taxes (PILT): Port authorities administer federal Crown land that is restricted to development related to supporting the growth of Canadian trade. Unleased federal crown land in Canada is NOT subject to municipal property tax, nor is it subject to the BC Ports Property Tax Act. Instead, the port authority provides payments directly to the municipal government as an equal replacement for property taxes. The amount of the payment is determined by a combination of a market appraisal of the property value and the classification of the property type and how the corresponding municipal tax rate applies. In Prince Rupert, this is primarily vacant industrial land that has not been leased by PRPA to a third-party, but also includes PRPA-owned and operated assets. Read more about the federal Payments in Lieu of Taxes program here.

What is the BC Ports Property Tax Act?

BC’s Ports Property Tax Act (the ‘Act’) was introduced in 2004 to regulate the amount of property taxes payable on port terminals. The Act was made permanent legislation in 2014.

The objective of the Act is to provide stability and predictability to the taxation environment of port terminals within the province to attract investment and position BC as a competitive global trade gateway, especially as it relates to US-based West Coast ports. In general terms, the Act places limitations on local government port property taxation while compensating municipalities for potential lost revenue through a provincial grant mechanism.

Under the Act, there are two values used to regulate the maximum allowable amount of taxes payable. They are land value, as calculated through an increase against the Consumer Price Index on a base year of 2007, and a cap to the mill rate of $27.50 per $1,000 of assessed value. This rate is significantly higher than residential rates.

For additional information on the BC Ports Property Tax Act, visit here.

How has municipal government revenue from Port properties changed over time?

In Prince Rupert, more than $1 billion of port terminal-specific investment has been realized since 2004, which has grown the local industrial tax base and municipal tax revenues.

PRPA property-related revenues to local government have grown to over $12 million in 2021, representing growth of almost $10 million since 2004.

Future port investments and growth will continue to grow municipal tax revenues according to their assessment, property class, and relevant mill rate.

How does municipal revenue collected from port properties compare to other property classes like residential and commercial?

More information on how municipal government tax revenues compare between property classes and sources can be found in publicly available audited financial statements, including for the City of Prince Rupert here and the District of Port Edward here.

More information on how local municipal government property tax revenues and tax burdens compare with other BC municipalities can be found in public information provided by the BC Government here.